The Facts About Pvm Accounting Uncovered

The Facts About Pvm Accounting Uncovered

Blog Article

Pvm Accounting - Truths

Table of ContentsPvm Accounting - The FactsA Biased View of Pvm AccountingThe Pvm Accounting IdeasSome Known Details About Pvm Accounting Rumored Buzz on Pvm AccountingExcitement About Pvm Accounting

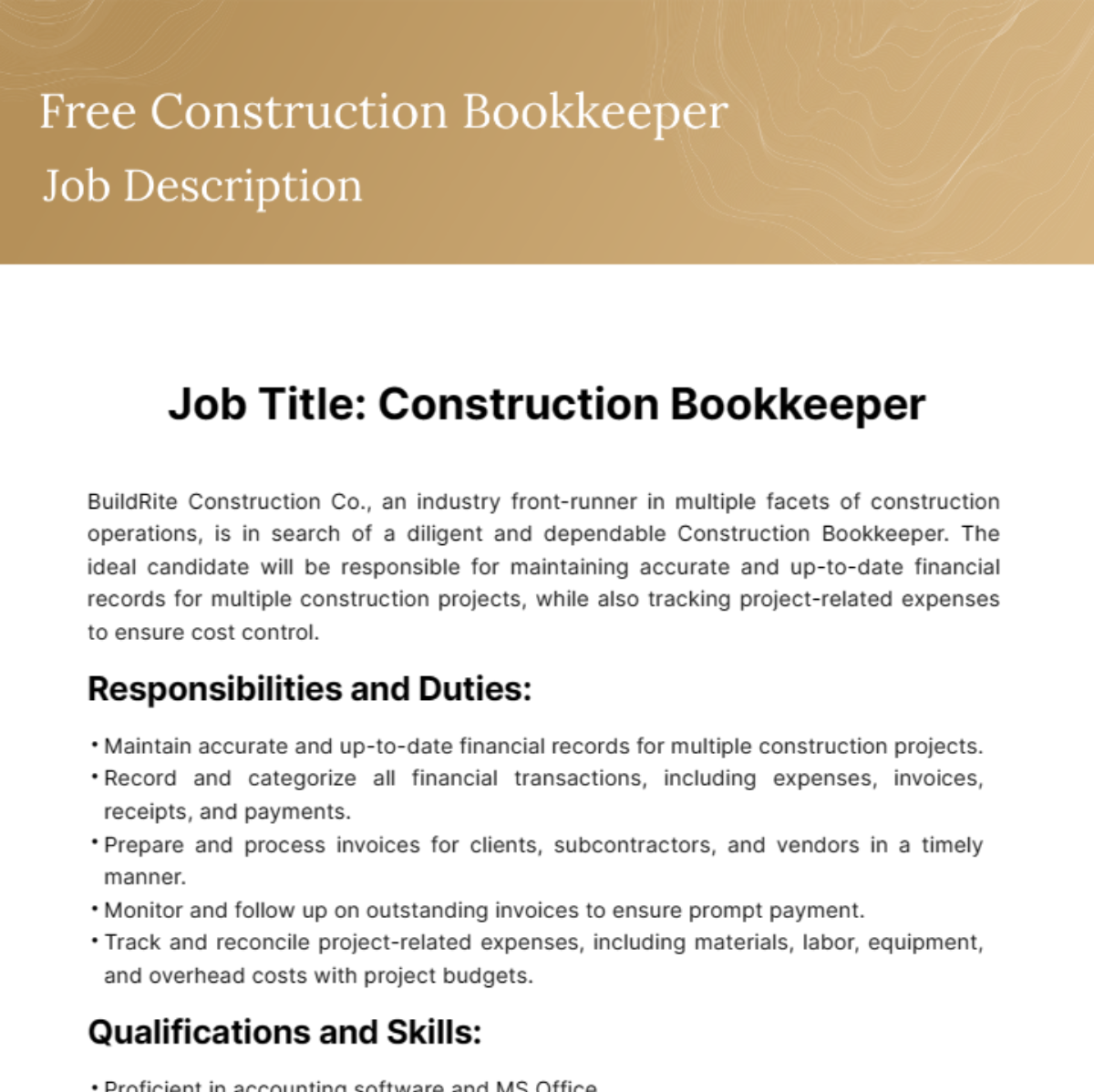

Make sure that the accountancy procedure complies with the legislation. Apply needed building and construction accounting standards and procedures to the recording and reporting of building task.Understand and keep conventional expense codes in the audit system. Connect with various funding companies (i.e. Title Firm, Escrow Firm) regarding the pay application process and demands needed for repayment. Take care of lien waiver dispensation and collection - https://triberr.com/pvmaccount1ng. Monitor and fix financial institution concerns consisting of cost anomalies and check differences. Help with carrying out and keeping inner economic controls and treatments.

The above declarations are meant to describe the general nature and degree of job being executed by individuals appointed to this category. They are not to be taken as an extensive listing of obligations, tasks, and skills required. Personnel might be needed to carry out responsibilities outside of their regular duties every so often, as needed.

Indicators on Pvm Accounting You Need To Know

Accel is looking for a Building Accounting professional for the Chicago Office. The Building Accounting professional carries out a range of audit, insurance coverage conformity, and task administration.

Principal responsibilities consist of, yet are not limited to, managing all accounting features of the company in a timely and precise way and giving records and schedules to the company's CPA Company in the prep work of all economic declarations. Ensures that all bookkeeping procedures and functions are handled properly. Liable for all monetary documents, pay-roll, financial and everyday procedure of the accountancy feature.

Prepares bi-weekly test equilibrium records. Works with Project Managers to prepare and upload all month-to-month billings. Processes and issues all accounts payable and subcontractor payments. Generates month-to-month wrap-ups for Workers Compensation and General Responsibility insurance premiums. Generates regular monthly Task Price to Date records and collaborating with PMs to resolve with Task Supervisors' allocate each job.

Top Guidelines Of Pvm Accounting

Effectiveness in Sage 300 Building and Real Estate (formerly Sage Timberline Workplace) and Procore construction management software program a plus. https://qualtricsxm393lvkdr7.qualtrics.com/jfe/form/SV_1ZFKTDPbSLOjslU. Must also excel in other computer software program systems for the preparation of records, spreadsheets and various other accounting analysis that might be needed by monitoring. construction bookkeeping. Need to have solid organizational abilities and capacity to prioritize

They are the monetary custodians who guarantee that building and construction projects remain on spending plan, adhere to tax obligation regulations, and keep economic transparency. Building accounting professionals are not simply number crunchers; they are tactical partners in the building process. Their key role is to manage the financial aspects of building jobs, making certain that resources are allocated successfully and financial risks are reduced.

The Main Principles Of Pvm Accounting

By maintaining a limited grip on task financial resources, accountants aid avoid overspending and financial obstacles. Budgeting is a cornerstone of effective building tasks, and building accounting professionals are instrumental in this respect.

Navigating the complicated web of tax obligation regulations in the building industry can be difficult. Building and construction accountants are fluent in these policies and make certain that the project abides by all tax obligation demands. This consists of managing pay-roll tax obligations, sales taxes, and any type of various other tax commitments details to building. To master the role of a building and construction accounting professional, individuals need a strong educational foundation in accountancy and money.

In addition, certifications such as Certified Public Accountant (CPA) or Licensed Building And Construction Industry Financial Specialist (CCIFP) are highly related to in the industry. Functioning as an accountant in the building market features an unique set of difficulties. Building projects typically entail limited due dates, altering guidelines, and unexpected costs. Accounting professionals have to adjust promptly to these difficulties to keep the job's financial health intact.

The Single Strategy To Use For Pvm Accounting

Ans: Construction accounting professionals produce and monitor spending plans, identifying cost-saving possibilities and making sure that the project remains within budget plan. Ans: Yes, construction accounting professionals handle tax conformity for construction tasks.

Introduction to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms have to make hard options amongst lots of financial options, like bidding process on one project over an site web additional, choosing financing for products or devices, or setting a project's earnings margin. Construction is a notoriously unpredictable industry with a high failure price, slow-moving time to repayment, and irregular cash flow.

Manufacturing includes duplicated processes with quickly recognizable costs. Manufacturing calls for different procedures, products, and equipment with differing prices. Each project takes location in a brand-new location with differing site problems and unique difficulties.

Pvm Accounting for Beginners

Durable partnerships with suppliers ease negotiations and improve efficiency. Inconsistent. Frequent use of different specialty professionals and vendors impacts performance and cash money circulation. No retainage. Repayment shows up completely or with normal settlements for the complete agreement amount. Retainage. Some part of settlement might be held back up until job conclusion also when the service provider's job is ended up.

Normal production and short-term agreements result in manageable cash money circulation cycles. Irregular. Retainage, slow-moving repayments, and high in advance prices cause long, irregular cash money circulation cycles - financial reports. While standard producers have the benefit of controlled environments and enhanced production procedures, building companies need to continuously adjust to every brand-new project. Also somewhat repeatable tasks require alterations due to website conditions and other elements.

Report this page